For example, suppose you’re amending your return to add a business expense.

In addition to Form 1040x, you’ll also need any additional forms or schedules that the change will impact. You also need any new documents supporting the amendment, such as a new W-2 or 1099 or receipts for a deduction you want to claim. To file an amended return, you need a copy of your original return. Here’s a step-by-step look at the process. The procedure for filing an amended return is pretty straightforward.

Turbotax 1040x amendment how to#

Not Ready to File? How to Request a U.S.Keep These Tips in Mind When Filing Small Business Taxes for the First Time in the U.S.If you’re outside of that window, you cannot file an amended return, even if doing so would get you a hefty tax refund. In that case, the last day to file a tax amendment or an amended return for the 2021 tax year would be April 18, 2025. Within 2 years of paying the tax due for that year, whichever is laterįor example, say you filed your 2021 tax return on the original tax filing deadline of April 18, 2022, and paid the tax due on that date as well.Within 3 years of the original filing deadline, or.That’s the earliest you can amend a tax return, but there’s also a limit on the amount of time you have to file an amended return.

Waiting until the IRS processes your return ensures the IRS doesn’t get your original return and amended tax return mixed up. You can do this by logging into your IRS.gov account or using the IRS’s Where’s My Refund? tool. When to File Form 1040xīefore filing an amended return, you should confirm that the IRS has processed the tax return you need to correct. This may require the owner or shareholder to file Form 1040x to correct their individual tax return for that year. In that case, they will issue a corrected Schedule K-1 to the owner or shareholder. However, suppose a pass-through business files an amended return that impacts the owner or shareholder’s share of income and deductions. They simply use the same form to file their original return and check the “Amended return” box at the top of the first page. S corporations that file Form 1120-S and C corporations that file Form 1120 don’t need to use a special form. Partnerships and LLCs that file Form 1065 use Form 1065-X to amend their returns. Only business owners who report their company’s income and deductions on Schedule C use Form 1040x to amend a business return.

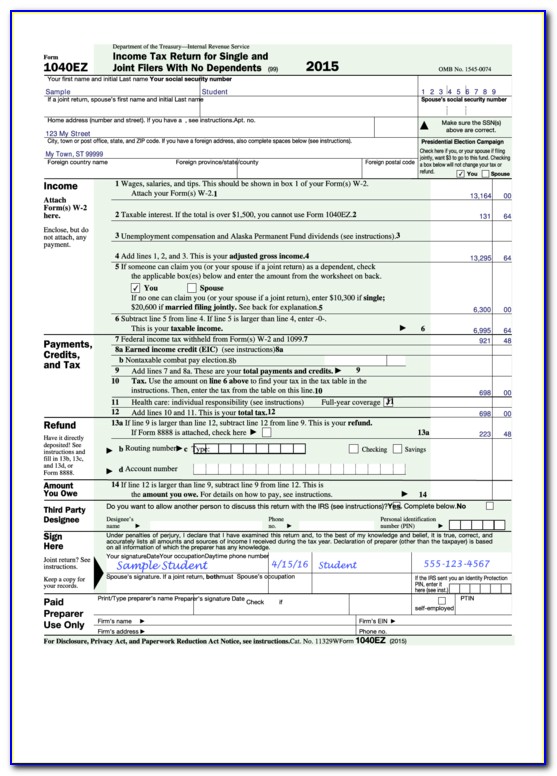

Who Files Form 1040x?įorm 1040x is the form used to amend individual income tax returns.

If you disagree with the IRS’s proposed changes entirely, respond to the IRS with a letter explaining why your original return is correct. In that case, send your amended tax return to the address shown in the notice to clarify which changes you disagree with. However, you can file an amended tax return if you receive a notice of proposed changes to your tax return-usually an IRS Notice CP2000-and partially agree with the changes. Just keep a copy of the notice so you can start next year’s return with the correct information. You also don’t need to file an amended tax return if you receive a notice of change from the IRS and agree with their changes. It then sends a CP11 or CP12 notice, informing you of the correction and, if necessary, the additional tax you owe or additional refund you can expect. The IRS tends to correct those mistakes on its own. You don’t need to file Form 1040x if you discover a simple math or clerical error on a recently filed return.

0 kommentar(er)

0 kommentar(er)